Navigating through Water Scarcity

TLDR

The Panama Canal faces sustainability challenges due to water scarcity, impacting global trade.

Reduced traffic flow leads to significant financial losses and operational disruptions.

Shipping companies must choose costly alternatives or redirect shipments through longer routes.

The Canal is a key player in reducing carbon dioxide (CO2) emissions by reducing distance and fuel usage.

Addressing sustainability challenges requires responsible water management and collaboration among stakeholders.

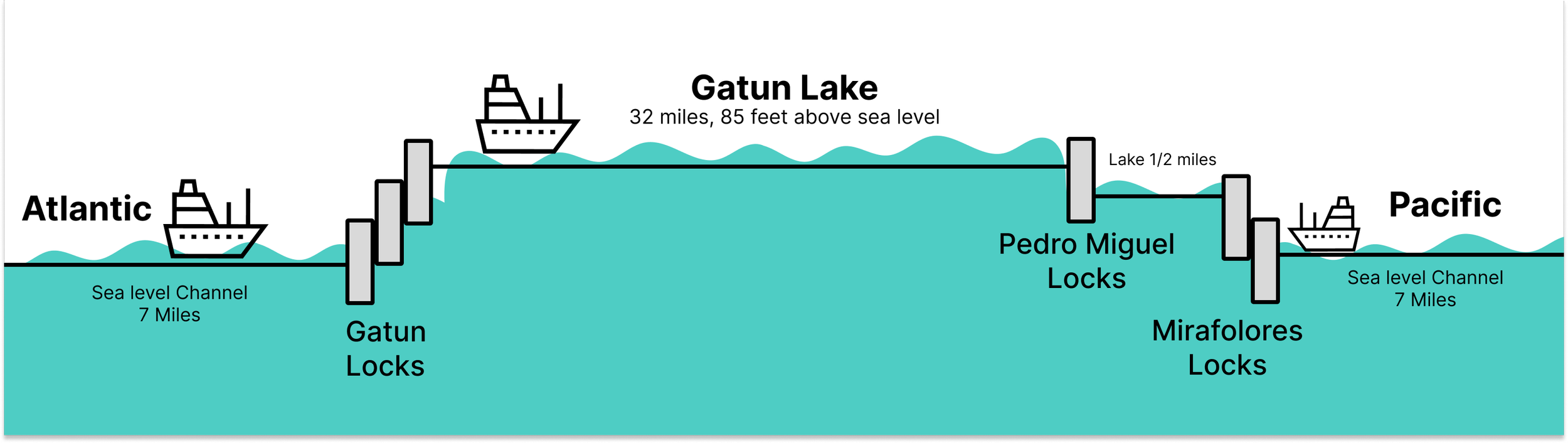

The Panama Canal, an engineering marvel that has served as a crucial link in global trade since its inauguration in 1914, connects the Atlantic and Pacific oceans. The canal offers an important shortcut that has transformed the landscape of international trade by enhancing connectivity and economic interchange among nations and markets worldwide. On an annual basis, approximately 2.5% of the world's maritime trade traverses the locks of the Panama Canal. Notably, in 2023 alone, over 14,000 vessels navigated this critical pathway linking the Atlantic and Pacific oceans. However, the Panama Canal now confronts formidable sustainability challenges, primarily stemming from escalating water scarcity concerns.

What is happening?

The Gatun Lake, engineered to provide freshwater for the canal's locks, lies in the heart of the canal. Each passage of a ship through the canal requires 200 million liters of freshwater equivalent to the daily water consumption of half a million Panamanians (🤯). The man-made lake has historically depended on rainfall for its supply. However, recent droughts and temperature fluctuations due to the El Niño Phenomenon have disrupted rainfall patterns. Despite Panama's equatorial climate, typically one of the wettest, rainfall has been 30% below average. Consequently, water levels in Lago Gatun have significantly declined, impacting the canal's operations and prompting restrictions on traffic.

Impacts of water scarcity in the Canal

The Panama Canal is currently experiencing significantly reduced traffic flow, resulting in anticipated losses of tens of millions of dollars. The Canal Authority, which typically accommodates 40 ships daily, has scaled down the number of passages to 32. These measures, including lowered weight limits and fewer transits, are causing delays and disruptions across global supply chains. The projected waiting time for unreserved passage through the canal now exceeds approximately nine months. An estimated portion of global trade, approximately 5%, and a significant share of U.S. container traffic, around 40%, traverse the Panama Canal. Consequently, any logistical disruptions in the canal could potentially exacerbate global price pressures, especially affecting industries reliant on timely transport, such as food and energy. The risk of perishable items and energy exports becoming trapped in transit adds further urgency to addressing the current challenges facing the canal.

JPMorgan analyst Steven Palacio said :

“The situation is relevant both domestically—as transportation accounts for a large share of GDP—and internationally, as the canal is an important trade route, particularly for the US. On the domestic side, this would pose downside risks to our 2023 GDP growth forecast of 5%y/y, but upside risks had been building elsewhere in the economy, so we see risks balanced.”

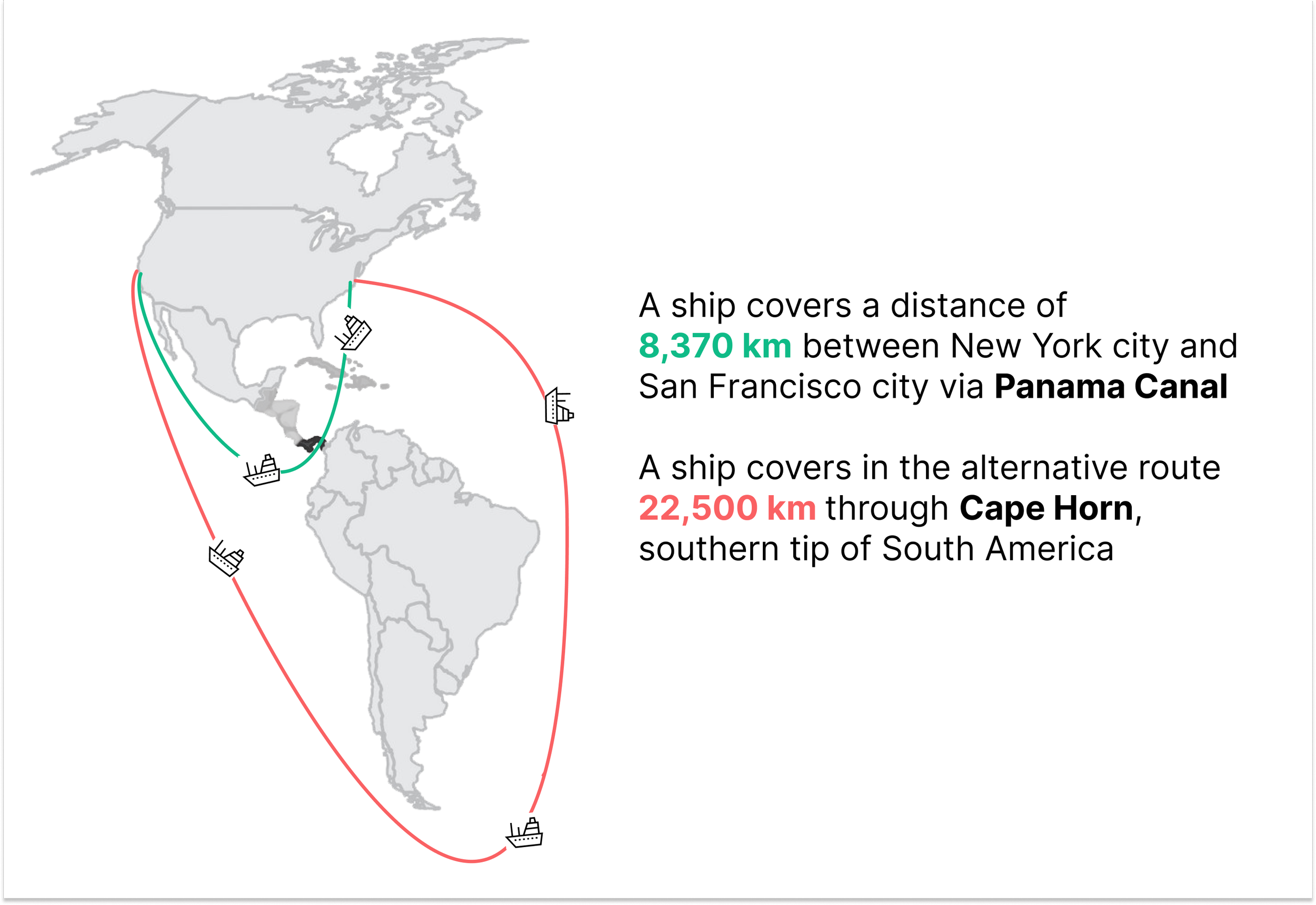

In response to these challenges, companies are confronted with three costly alternatives. Firstly, they may opt to endure extended waits, subjecting themselves to further delays and operational uncertainties. Secondly, they could choose to pay substantial fees to expedite their passage through the canal at significant financial expense. Lastly, companies may redirect their shipments to longer routes, bypassing the canal entirely. For instance, instead of utilizing the Panama Canal for return trips to China, many vessels are choosing alternative routes like the Suez Canal, Cape of Good Hope or Cape Horn. Traveling through the Panama Canal takes only 35 days while shipping cargo from Shenzhen, China, to Miami, Florida, while using the Suez Canal takes 41 days. Even though these voyages are longer, they circumvent congestion and eliminate the need for reduced cargo loads. But, the potential scarcity or elevated prices of goods transported via the canal could have detrimental effects on businesses and consumers.

Impacts on global supply chain

A shipping company heavily reliant on the Panama Canal for its transoceanic routes has failed to adjust its supply chain strategy to mitigate the impact of water scarcity-induced disruptions. Consequently, the company faces significant delays in shipping schedules, leading to heightened fuel costs, vessel idle time, and missed delivery deadlines. These operational inefficiencies have resulted in substantial financial losses, eroding profit margins and shareholder value. For instance, Maersk, one of the world's largest container shipping companies, incurred losses amounting to millions of dollars due to delays and rerouting caused by disruptions along the Panama Canal's route. In response, Maersk has implemented alternative measures, such as utilizing a 'land bridge' for Oceania cargo. This involves vessels calling at the Ports of Balboa, Panama, with containers then transported across Panama by rail. Additionally, Maersk has adjusted its services to minimize disruptions for customers, including the cessation of its shipping route to Cartagena, Colombia, and advisories regarding potential delays for southbound vessels. Furthermore, Maersk is exploring the construction of post-Neo-Panamax (PNPX) container ships, aiming to offer competitive slot costs and greater flexibility in serving various trades, demonstrating its commitment to operational optimization and potential environmental footprint reduction.

Similarly, major players in the shipping industry, such as the Ocean's Alliance, comprising COSCO Shipping, Evergreen Line, CMA CGM, and OOCL, are grappling with these challenges. This consortium dominates key trade routes like Asia-Europe and Asia-North America(10). Delays at the Panama Canal have resulted in increased costs for industry giants like MSC, impacting firms within the alliance. These disruptions escalate fuel consumption and expenses, affecting the overall cost efficiency of operations. As delays for container ships continue to mount, they exert significant pressure on the logistics chain, raising industry concerns about the widespread repercussions for global trade and supply chains.

An Example of how ships have to redirect their voyage in order to meet supply chain demands.

Impact on the planet

The impact of the drought reaches beyond the operational scope of the Panama Canal, affecting wider environmental aspects in nearby communities and ecosystems. This highlights the urgent need for adopting sustainable water management practices and policies to address water scarcity issues in the region. Especially since using the canal brings incredibly positive outcomes. Historically, it has played a key role in reducing carbon dioxide (CO2) emissions by more than 830 million tons since its inauguration. This reduction is attributed to its facilitation of shorter voyages and decreased cargo movements compared to alternative transportation modes like air, land, or rail. However, the decision to redirect shipments onto longer routes carries environmental consequences, including increased fuel consumption and higher greenhouse gas emissions (GHG).

The Panama Canal efforts to mitigate impacts

The Panama Canal Authority has been implementing various measures to address the drought issues affecting the canal. It has initiated water-saving actions that address the low levels in the canal. These include reusing water for different lock chambers and allowing the transit of two ships at a time if vessels are small. By implementing these, the canal aims to optimize water usage and improve operational efficiency. Another option is using water from the Indio River outside the canal's watershed and making it an additional reservoir. Although this project requires government approval, it could provide additional freshwater supply for the canal during dry seasons.

The Panama Canal's sustainability challenges serve as a wake-up call for companies to embrace responsible supply chain management practices. The failure to adapt to sustainability concerns poses significant risks, including financial losses, reputational damage, and regulatory penalties. By prioritizing sustainability, investing in resilience, and fostering collaboration across stakeholders, companies can navigate the uncertainties of the Panama Canal and emerge stronger, more agile, and better equipped to thrive in an ever-changing global marketplace.

Sources:

1. https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/how-could-panama-canal-restrictions-affect-supply-chains

2. https://www.nytimes.com/2023/11/01/business/economy/panama-canal-drought-shipping.html

3. https://cuencahighlife.com/latin-american-countries-are-running-out-of-water/

4. https://www.france24.com/en/live-news/20230913-panama-seeks-new-sources-of-water-for-canal

5. https://eu.usatoday.com/story/money/2023/08/28/panama-canal-cargo-ship-restrictions-drought/70685156007/

6. https://www.focus-economics.com/blog/how-will-the-panama-canal-drought-affect-the-economy-and-global-trade/

7. https://www.cnbc.com/2024/01/11/panama-canal-drought-moves-maersk-to-start-using-land-bridge-for-cargo.html

8. https://globaledge.msu.edu/blog/post/57282/how-a-drought-is-affecting-the-panama-canal-and-global-supply-chain

9. https://container-news.com/box-lines-could-order-modern-version-of-neo-panamax-vessels/

10. https://container-news.com/ocean-alliances-dominant-era-comes-after-2m-breakup/

11. https://www.shiplilly.com/blog/global-shipping-disrupted-by-long-wait-times-at-the-panama-canal/

12. https://ajot.com/news/connecting-the-world-through-the-panama-canal

13. https://foreignpolicy.com/2024/01/15/panama-suez-canal-global-shipping-crisis-climate-change-drought/

14. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/lng/112223-panama-canal-proposes-long-term-solutions-to-improve-drought-issues-as-low-water-levels-remain

15. https://distributionstrategy.com/shipping-backlogs-are-back-and-this-time-it-is-the-panama-canal/